There’s a cruel irony to poverty.

The less you have, the more you pay.

You’d think being broke would be the ultimate money-saving lifestyle – lol!

No fancy dinners, no high-end clothes, no unnecessary indulgences.

But in reality, poverty is a trap, an expensive one, and the system is designed to keep it that way.

The Cost of Buying Cheap

When you’re living pay check to pay check, bulk discounts are a fantasy.

If you can afford to, it’s cheaper to stock up on non-perishables – cut-price pasta and discounted detergent – at wholesale prices.

If you can’t, you buy what you can afford in the moment. Which usually means smaller and more expensive.

Let’s talk toilet roll. A 24-pack of decent-quality rolls costs, say, €10, while a four-pack costs €3. The person with €10 to spare saves money in the long run, while the person scraping by spends more over time for the privilege of not having €10 all at once.

Extend that across every household necessity, and you’re looking at an invisible tax on poverty.

And it gets worse. Cheap goods don’t last.

The budget kettle, the knockoff shoes, the second hand car with just enough miles left in it to see you to the next financial disaster – all destined to break, forcing you to replace them again and again, while wealthier buyers make a single investment in quality that lasts.

No Credit for the Broke

Then there’s credit – or rather, the lack of it. The rich borrow cheaply; the poor pay in blood. Need a loan? If you’ve got a steady income and a good credit score, you can borrow at 3% interest.

If you’re struggling, expect payday lenders, rent-to-own schemes and credit cards with interest rates that make loan sharks look like charitable benefactors. Miss a payment, and the late fees pile up, digging the hole deeper.

Car insurance? More expensive if you live in a poorer area.

Rent? Higher per month than a mortgage, but good luck securing a mortgage if you’re spending your would-be deposit on rent.

Banking fees? A nightmare if you dip into overdraft, which is, let’s face it, inevitable.

The High Price of Addiction

Now, let’s talk about survival in this capitalist economy.

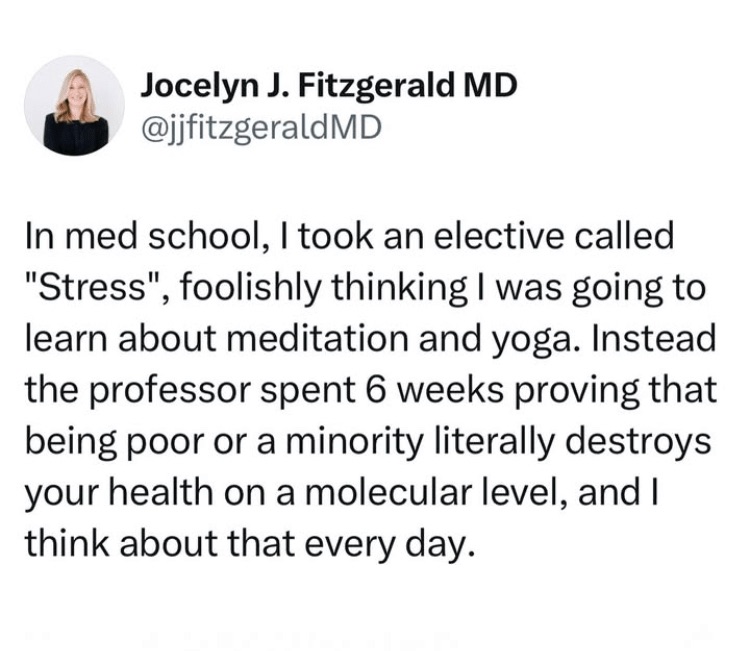

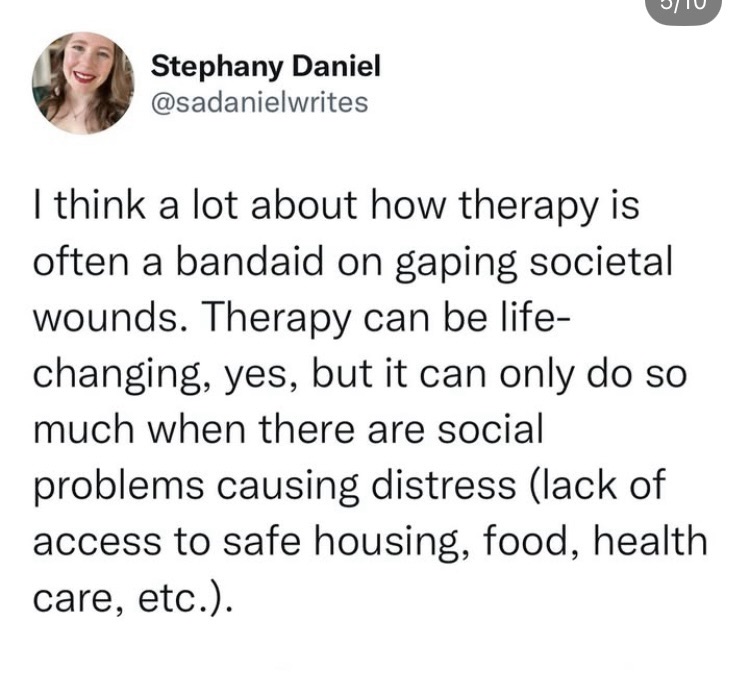

Life is exhausting when you’re poor. The stress alone is a health hazard, with constant worry about rent, bills, and whether you can stretch this week’s grocery budget far enough to keep everyone fed.

And stress, dear reader, drives consumption.

When you live with that level of pressure, you seek relief where you can get it.

And relief is never free. Fast food is an easy dopamine hit but costs more than home-cooked meals.

Alcohol, cigarettes, drugs – all come with staggering price tags, both in money and in long-term consequences.

It’s no accident that addiction rates are highest among the economically disadvantaged.

People don’t self-destruct for fun. They do it to cope.

And our system, rather than offering support, punishes them with higher taxes on fags and booze, making sure their suffering remains profitable.

A System Rigged to Bleed You Dry

The reality is that the modern economy runs on people being just comfortable enough to keep participating but never secure enough to break free. We are sold the illusion that if we work hard enough, save diligently, and make the “right” choices, we can climb out of the pit.

But here’s the truth: the pit has been designed to keep you in it.

We need to stop treating poverty as a personal failure and start calling it what it is: an expensive, deliberately engineered condition that keeps the money flowing upwards.

The first step to fixing it? Recognizing the game for what it is.

Leave a comment